From Lew Rockwell.com:

What Hamilton Has Wrought

by Thomas J. DiLorenzo

by Thomas J. DiLorenzo

DIGG THIS

The current economic crisis is the inevitable consequence of what I call Hamilton’s Curse in my new book of that name. It is the legacy of Alexander Hamilton and his political, economic, and constitutional philosophy. As George Will once wrote, Americans are fond of quoting Jefferson, but we live in Hamilton’s country.

The great debate between Hamilton and Jefferson over the purpose of government, which animates American politics to this day, was very much about economic policy. Hamilton was a compulsive statist who wanted to bring the corrupt British mercantilist system – the very system the American Revolution was fought to escape from – to America. He fought fiercely for his program of corporate welfare, protectionist tariffs, public debt, pervasive taxation, and a central bank run by politicians and their appointees out of the nation’s capital.

Jefferson and his followers opposed him every step of the way because they understood that Hamilton’s agenda was totally destructive of liberty. And unlike Hamilton, they took Adam Smith’s warnings against economic interventionism seriously.

Hamilton complained to George Washington that "we need a government of more energy" and expressed disgust over "an excessive concern for liberty in public men" like Jefferson. Hamilton "had perhaps the highest respect for government of any important American political thinker who ever lived," wrote Hamilton biographer Clinton Rossiter.

Hamilton and his political compatriots, the Federalists, understood that a mercantilist empire is a very bad thing if you are on the paying end, as the colonists were. But if you are on the receiving end, that’s altogether different. It’s good to be the king, as Mel Brooks would say.

Hamilton was neither the inventor of capitalism in America nor "the prophet of the capitalist revolution in America," as biographer Ron Chernow ludicrously asserts. He was the instigator of "crony capitalism," or government primarily for the benefit of the well-connected business class. Far from advocating capitalism, Hamilton was "befogged in the mists of mercantilism" according to the great late nineteenth century sociologist William Graham Sumner.

The Curse of Government Debt

In a lengthy "report" to Congress on the topic of the public debt Hamilton said that "a national debt, if it is not excessive, will be to us a public blessing." He would spend the rest of his life politicking for excessive government spending – and debt. The reason Hamilton gave for favoring a large public debt was not to finance any particular project, or to stabilize financial markets, but to combine the interests of the affluent people of the country – particularly business people – to the government. As the owners of government bonds, he reasoned, they would forever support his agenda of higher taxes and bigger government. (He condemned Jefferson’s first inaugural address and its minimal government message as "the symptom of a pygmy mind.") No wonder one historian entitled his book on Hamilton "American Machiavelli."

Wall Street financiers naturally took an immediate liking to Hamilton’s idea, and became the financial cornerstone of the Federalist Party (and later, the Whigs and Republicans). When Hamilton engineered the nationalization of the states’ debt as treasury secretary – something that was totally unnecessary since many states like Virginia had nearly paid off their war debts – the plan was to cash out much of the old debt at face value. This immediately became public knowledge in New York City, but the news spread ever so slowly to the rest of the country. Consequently, Hamilton’s friends and supporters from New York City and New England went on a mad scramble down the eastern seaboard, purchasing bonds from hapless war veterans (who had been paid in bonds) for as little as two percent of par value. Huge fortunes were made by these slick New York speculators. Robert Morris pocketed a nifty $18 million. John Quincy Adams wrote to his father that the wealthiest Federalist lawyer in Massachusetts made a huge fortune with this caper. Hamilton participated in this parade of plunder himself, but claimed that the profits he made were for his brother-in-law.

The link between Wall Street and the federal government was cemented into place later on, when investment banks took on the responsibility of marketing the government’s bonds, which of course they still do to this day. Thus, Wall Street investment bankers became inveterate lobbyists for any and all tax increases (on the rest of the population, anyway) to assure that their own principal and interest would be paid, and that they could promise their clients – the purchasers of government bonds – that the bonds were a good investment. They were corrupt from the very beginning.

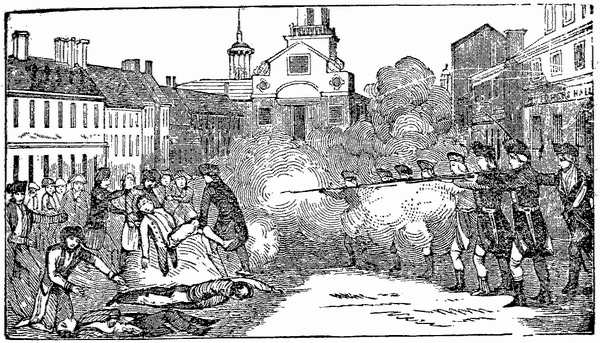

When Hamilton and George Washington led some 15,000 conscripts into Pennsylvania to enforce the hated whiskey tax, the purpose was not only to collect the tax and reassure bondholders, but also to send a message to any future tax resisters. The volunteer officers who led the conscripts were mostly "from the ranks of the creditor aristocracy in the seaboard cities," wrote Claude Bowers in Jefferson and Hamilton. (The rebellion succeeded, nevertheless. George Washington pardoned all of the tax protesters despite Hamilton’s hysterical opposition and his desire to hang all of them.)

James Madison remarked that this episode revealed Hamilton’s agenda of "the glories of a United States woven together by a system of tax collectors." Douglas Adair, an editor of The Federalist Papers, wrote that "with devious brilliance, Hamilton set out, by a program of class legislation, to unite the propertied interests of the eastern seaboard into a cohesive administration party." He also "transformed every financial transaction of the Treasury Department into an orgy of speculation and graft in which selected senators, congressmen, and certain of their richer constituents . . . participated." If this sounds familiar it is because the political descendants of these eighteenth-century "propertied interests" are today’s benefactors of the Wall Street Plutocrat/D.C. Political Class $700 Billion Bailout Bill of 2008.

When Hamilton’s Federalist Party consolidated its power during the Adams administration, government spending and debt skyrocketed. Citizens were prohibited to criticize it, however, thanks to the Sedition Act that outlawed free political speech. The national debt was so large that 80 percent of the government’s annual expenditures were needed to service the debt. This was exactly what Hamilton wanted. As John C. Miller, author of The Federalist Era, wrote, Hamilton’s main objective was "concentrating economic and political power in the Federal government," even if it meant destabilizing the entire nation’s economy.

The Founding Father of Central Banking

Hamilton is also considered to be the founding father of central banking since America’s first central bank, the Bank of the United States (BUS), existed primarily due to his efforts as Treasury Secretary. As William Graham Sumner wrote in his biography of Hamilton, however, "[A] national bank . . . was not essential to the work of the Federal Government." The real purpose of Hamilton’s bank, Sumner believed, was "the interweaving of the interests of wealthy men with those of their government." And interweave it did, providing cheap credit to business supporters of the Federalist Party, attempting to engineer boom-and-bust cycles to influence elections (called "political business cycles" in today’s parlance) and even financing the political campaigns of BUS supporters.

The BUS was a disaster for the general public, however; excessive money creating by the BUS printing press caused 72 percent inflation in its first five years, from 1791 to 1796. It became so unpopular that its twenty-year charter was not renewed, but then the War of 1812 gave it a new life, and it was resurrected in 1817. It immediately caused the Panic of 1819, and did what all central banks have always done: generated boom-and-bust cycles for the next twenty years. The bursting of the housing bubble in our time is the latest example of this hoary tradition.

Hamilton’s BUS was de-funded by President Andrew Jackson, and then a version of it was resurrected once again in 1863 by the neo-Hamiltonian Lincoln administration with several National Currency Acts. This, and other interventions of that period (50 percent average tariff rates, massive corporate welfare for the railroad industry, income taxation, pervasive excise taxation), led historian Leonard Curry to observe in his book, Blueprint for Modern America: Nonmilitary Legislation of the First Civil War Congress, that the interventions "ushered in four decades of neo-Hamiltonianism: government for the benefit of the privileged few."

The record of Hamiltonian central banking from that time until the Fed was created in 1913 was summarized in a scholarly paper by economists Michael Bordo, Anna Schwartz and Peter Rappaport: "monetary and cyclical instability, four banking panics, frequent stock market crashes, and other financial disturbances." The Wall Street elite’s response to all this central bank-induced monetary instability was even more centralized banking with the creation of the Federal Reserve Board. It may have meant instability to the ordinary citizens, but was the source of great riches to the banking industry and other members of the politically well-connected class. Sound familiar?

Things have not changed at all to this day. A recent Fed publication entitled "A History of Central Banking in the United States" proudly boasts that "the Federal Reserve has similarities to the country’s first attempt at central banking, and in that regard it owes an intellectual debt to Alexander Hamilton" who, the Fed says, "sounded like a modern-day Fed chairman."

When Jefferson and his followers fiercely opposed Hamiltonian statism they were fighting to avoid bringing the rotten, corrupt, and economically-impoverishing system of British mercantilism to America. They understood what Adam Smith wrote in The Wealth of Nations, which was a harsh condemnation of British mercantilism as both corrupt and impoverishing. Indeed, many of these men (or their ancestors) came to America in the first place to escape from that very system. Hamilton mocked Adam Smith just as he mocked Jefferson’s "pygmy mind" and his "excessive concern for liberty."

It may have taken several generations, but that system of "crony capitalism" or "government for the benefit of the privileged few" has been cemented into place for quite some time now. The politically incestuous relation between the banking and finance industries and government is the sole cause of the current economic crisis, particularly the boom-and-bust cycle caused by the Fed and the system of fractional reserve banking (i.e., lending money that you don’t have) that it administers. Hamilton’s Curse is plaguing America once again.

October 6, 2008

Thomas J. DiLorenzo [send him mail] is professor of economics at Loyola College in Maryland and the author of The Real Lincoln; Lincoln Unmasked: What You’re Not Supposed To Know about Dishonest Abe and How Capitalism Saved America. His latest book, Hamilton’s Curse: How Jefferson’s Archenemy Betrayed the American Revolution – And What It Means for America Today, will be published on October 21.

Copyright © 2008 LewRockwell.com

Thomas DiLorenzo Archives at LRC

Thomas DiLorenzo Archives at Mises.org

Wednesday, September 29, 2010

Subscribe to:

Post Comments (Atom)

.gif)

No comments:

Post a Comment